Hi Jason,

In short, no it's not possible to have an account against an Investment account.

Investment accounts are just a placeholder for Share Investments and could be considered as a portfolio. When you set up a share investment, you also have the option of the Share Account, I recommend saying yes but it's a choice. These share accounts are little weird to use as they don't appear in the app by default (you have to enabled from menu) and many reports seem to ignore them but they do come out on the transaction report.

If you don't use share accounts, then the investment account will only hold headline information, it's also weird as the 1st transaction doesn't seem to take the money from anywhere so if you choose to not use share accounts then when you 1st add the share to the investment account enter only the company name and stock code and current price, zero the other values unless you aren't tracking where the funds came from. Once you have added the Share to the Investment, then you can add a transaction to the share which will allow you to identify where the funds came from or go to - usually the broker account.

The way I use the app is to set-up an Investment Account for the Broker/Portfolio and set-up a Bank or Cash Account for the Broker/Portfolio

Then I add Share/Investments into the Investment account (and create the share account), the account for purchase/sale is always the share account.

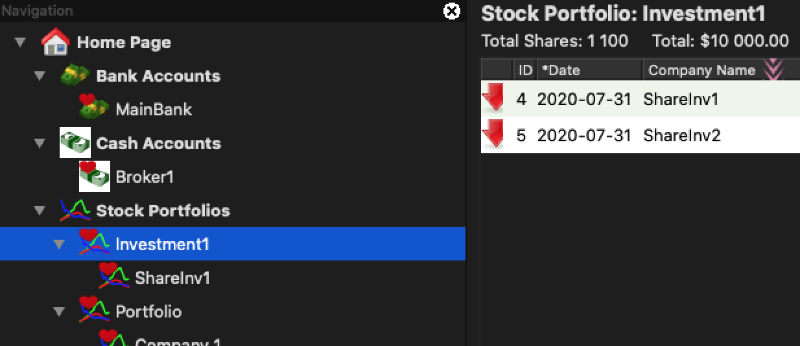

The reason it that the share account appears under the investment account in the nav tree and clicking it shows all the transactions in for the share account.

If you want to use share accounts, then all purchase, sale, dividends, charges/commission associated with that share goes into the share account. Only purchase & sale can be done from the investment/share screens. The rest has to open the share account directly (menu option to show them).

You then transfer (cash sweep some brokers call it) any residual cash to the broker's account. General management fees charged by the broker go into the broker's account as it's not really worth it to calc the % charge per share.

There an overhead in this method as you needs to transfer the monies around but you can easily see all transactions for that share by clicking on the share in the investments section of the app (navigation panel).

Once it's set-up, then I set-up some scheduled transactions for regular transactions (e.g. dividends, annual/quarterly fees) and the transfer from share account to broker account.

Alternatively you can have all transactions coming into/out of the broker's account and therefore see everything in one place. To look at at an individual share you have do some form of filtering.

Advise you to create a payee for each share you invest in and this is the payee on all purchase/sale/dividends/etc. it'll also allow you to filter easier. Also set-up category for Shares and subcategories for Purchase, Sale, Dividends, Fees, Charges.

- ShareInv1 has share account, ShareInv2 & 3 don't

- Screenshot 2020-07-31 at 2.55.45 PM.png (82.1 KiB) Viewed 45200 times